Servicemembers facing financial crises can access car title loans with specific federal protections in place, such as interest rate caps and loan transparency. These 'Car Title Loan Servicemembers Protections' ensure fair practices, especially for specialized financing like semi-truck loans, preventing debt traps. Post-service, veterans can leverage these guidelines for flexible funding using their vehicle equity when financial challenges arise.

“In today’s challenging financial landscape, ensuring financial security is paramount, especially for military service members. ‘Car Title Loan Servicemembers Protections’ serve as a crucial safety net, safeguarding their economic well-being. This article delves into the intricacies of these protections, highlighting how they empower troops with access to quick cash while mitigating risks. By exploring the benefits and challenges, we uncover the vital role these safeguards play in fostering financial stability for our nation’s heroes.”

- Understanding Car Title Loan Servicemembers Protections

- Benefits of These Protections for Troops' Financial Security

- Navigating Challenges with Enhanced Title Loan Safeguards

Understanding Car Title Loan Servicemembers Protections

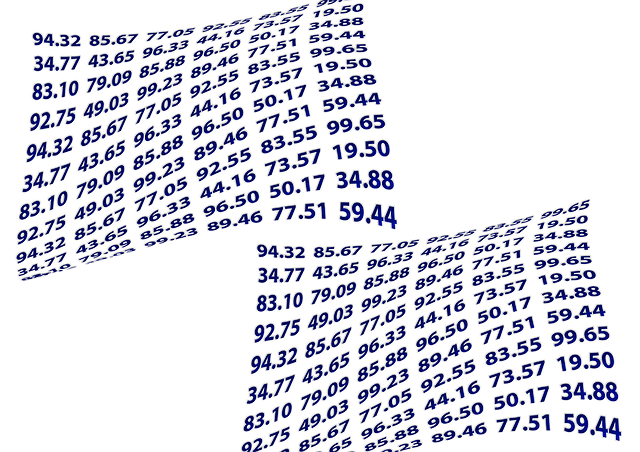

Servicemembers facing financial challenges often turn to car title loans as a quick solution. However, it’s crucial they understand the car title loan servicemembers protections in place to safeguard their interests. These protections, mandated by federal law (Servicemember Civil Relief Act), are designed to offer relief from high-interest rates and strict collection practices that may burden active-duty troops.

Many lenders cater specifically to military personnel, understanding the unique financial pressures they face. These loans often come with same day funding, which can be appealing in urgent situations. However, it’s important for servicemembers to carefully review loan requirements and understand the potential implications before agreeing to any terms. Transparency, clarity, and adherence to these protective measures are key to ensuring troops access much-needed funds without falling into a cycle of debt.

Benefits of These Protections for Troops' Financial Security

The implementation of Car Title Loan Servicemembers Protections is a significant step towards safeguarding the financial well-being of troops and military personnel. These protections offer several advantages, ensuring that service members can access much-needed funds without compromising their financial security. One of the key benefits is the elimination of strict credit checks, which are often a barrier for individuals with limited or no credit history. With these safeguards in place, troops can easily qualify for car title loans, providing them with a reliable source of emergency funding.

Additionally, the protections promote fairness and transparency in lending practices. Many troops, especially those deployed, may not have traditional credit options, making high-interest rates and unpredictable terms common concerns. The Car Title Loan Servicemembers Protections aim to mitigate these issues by setting clear guidelines, ensuring that lenders offer competitive rates and transparent repayment structures. This is particularly beneficial for those seeking semi-truck loans or other specialized financing, as it prevents them from falling into a cycle of debt with questionable lenders.

Navigating Challenges with Enhanced Title Loan Safeguards

Many service members face unique financial challenges upon their return from duty, often requiring quick solutions for immediate needs. This is where car title loan servicemembers protections come into play as a vital safety net. These safeguards are designed to ensure that troops can access much-needed funds while maintaining certain levels of financial security and stability.

Navigating the complexities of life after military service can be daunting, especially with unexpected expenses piling up. Enhanced title loan safeguards offer a sense of assurance by providing clear guidelines on interest rates, repayment terms, and protection against predatory lending practices. These measures allow servicemembers to secure quick funding through their vehicle’s equity while giving them the flexibility to explore options for loan extension or even loan payoff if their financial situation improves.

Car title loan servicemembers protections are invaluable tools that promote financial security for troops. By understanding these safeguards and their benefits, service members can make informed decisions about their short-term lending options. While challenges exist in navigating these laws, enhanced title loan safeguards ultimately foster a more secure financial environment for military personnel, ensuring they have access to critical resources without compromising their long-term stability.