Servicemembers facing car title loans can leverage powerful federal protections under the Servicemembers Civil Relief Act (SCRA), which limits lender demands and provides flexible payment plans tailored to their income and deployment schedules. State laws further safeguard against predatory practices, ensuring fair terms, transparent pricing, and reasonable extensions. These measures empower servicemembers to manage their financial obligations without compromising military duties.

“In today’s financial landscape, military personnel often face unique challenges when accessing credit. ‘Car title loan servicemembers protections’ are crucial safety nets designed to safeguard their financial stability. This article explores the intricate web of regulations that govern these agreements. We delve into the federal protections afforded to active-duty military, analyzing how they complement state laws aimed at preventing predatory lending practices. Understanding these legal frameworks is essential for servicemembers navigating car title loan deals, ensuring a transparent and secure process.”

- Understanding Car Title Loan Agreements for Servicemembers

- Federal Protections for Active Duty Military Personnel in Title Loans

- State Laws and Their Role in Safeguarding Servicemembers' Financial Well-being

Understanding Car Title Loan Agreements for Servicemembers

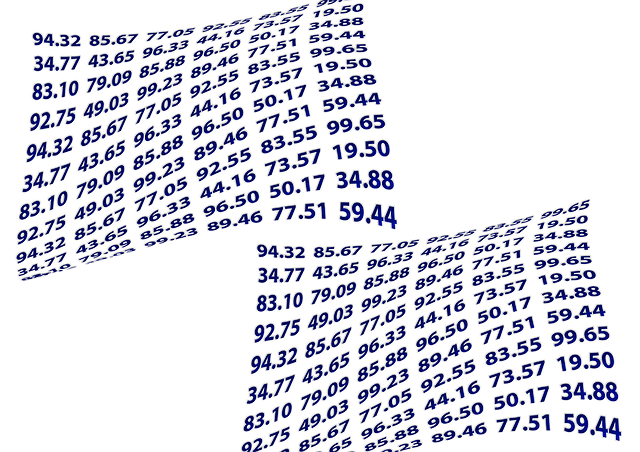

Servicemembers entering into car title loan agreements should be aware of specific protections afforded to them under federal law. The Servicemembers Civil Relief Act (SCRA) offers crucial safeguards, ensuring that active-duty military personnel face fewer financial hardships while serving their country. When it comes to car title loans, SCRA restricts lenders from demanding repayment in person or by telephone during certain periods, providing servicemembers with more control over their loan terms and conditions.

Understanding the loan requirements is essential for servicemembers considering this option. Lenders in Houston and elsewhere must adhere to strict guidelines, including offering flexible payment plans tailored to the borrower’s income and deployment schedules. This allows servicemembers to manage their loans effectively while ensuring they can fulfill their military obligations without financial strain.

Federal Protections for Active Duty Military Personnel in Title Loans

Active duty military personnel face unique financial challenges due to their specialized lifestyle and deployment schedules. Fortunately, several federal laws have been implemented to protect servicemembers in car title loan deals, ensuring they can access emergency funding when needed. These protections are designed to maintain stability for service members while serving our country.

One key protection is the Servicemember Civil Relief Act (SCRA), which offers various benefits, including stay of foreclosure and restriction on interest rates. This act also facilitates the process of keeping your vehicle by providing temporary relief from repossession during active military service. Additionally, many financial institutions now offer streamlined online applications for car title loans, catering to the needs of mobile servicemembers who require quick access to emergency funding while deployed or between assignments.

State Laws and Their Role in Safeguarding Servicemembers' Financial Well-being

State laws play a pivotal role in safeguarding the financial well-being of servicemembers when it comes to car title loans. These regulations are designed to protect active-duty military personnel and veterans from predatory lending practices that often target their unique circumstances. Many states have implemented specific laws and guidelines for car title loan transactions, ensuring fair treatment and transparent terms for servicemembers.

By establishing these protections, state laws aim to prevent servicemembers from falling into a cycle of debt. They often include provisions for quicker approval processes while considering the servicemember’s stable future income and promoting reasonable loan extension options. Additionally, state regulations may set clear guidelines on loan terms, interest rates, and fees, ensuring that servicemembers understand their financial obligations and have access to affordable repayment plans.

In conclusion, car title loan agreements for servicemembers come with a unique set of considerations. Understanding these agreements and leveraging federal as well as state laws is crucial in safeguarding their financial well-being. Active duty military personnel should be aware of the protections afforded to them under federal law, while also being informed about state-specific regulations that enhance their rights. By staying informed and navigating these protections, servicemembers can ensure they enter into title loan deals that are both safe and beneficial.